hard money lenders in Atlanta Georgia for Property Investors

hard money lenders in Atlanta Georgia for Property Investors

Blog Article

Why a Hard Cash Funding Could Be the Right Option for Your Next Financial Investment

In the realm of property financial investment, the fast rate and high stakes often demand unusual financing options. Get in hard money lendings, a device that focuses on swift authorization and financing, along with the residential property's worth over a customer's debt history. Despite their prospective high prices, these car loans might be the trick to opening your next profitable offer. What makes them a viable option, and when should they be considered? Allow's unravel the story.

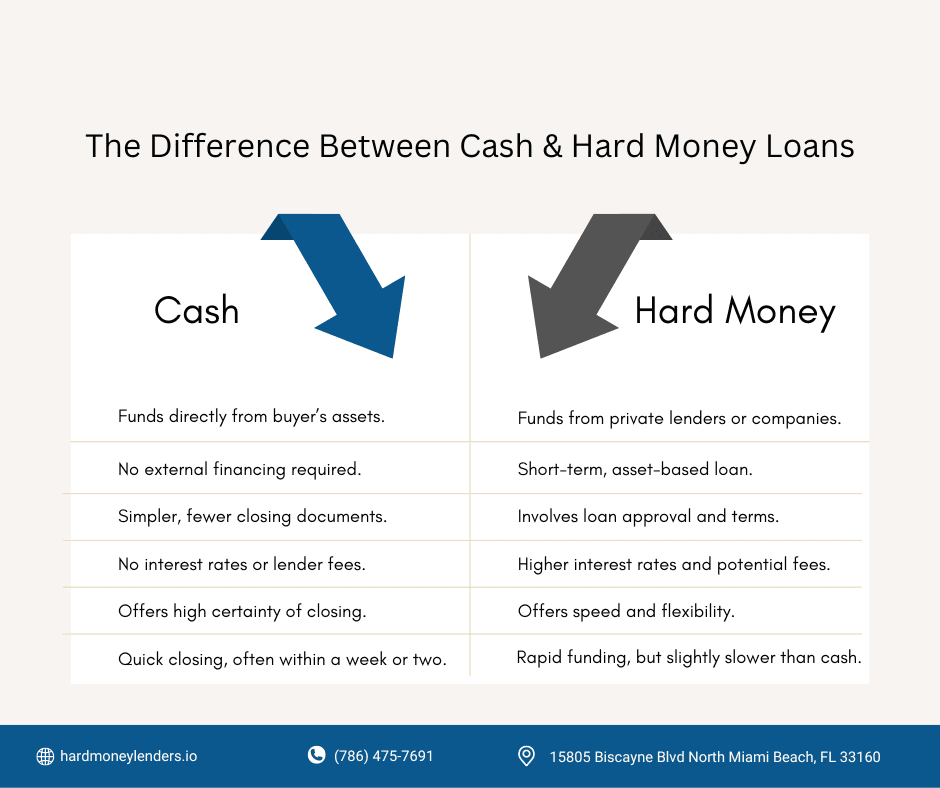

Comprehending the Essentials of Hard Money Car Loans

While conventional loans might be familiar to most, recognizing the fundamentals of tough money car loans is critical for possible financiers. Tough money car loans are a kind of short-term financing where the investor protects the Financing with real estate building as collateral. Lenders are typically personal firms or individuals, making the Loan terms and rates even more flexible than standard financial institution car loans.

The Benefits of Choosing Difficult Cash Car Loans

Possible Disadvantages of Difficult Money Financings

Despite the benefits, there are also potential disadvantages to take into consideration when taking care of tough money financings. The most remarkable is the high rate of interest. Considering that difficult money lending institutions take on even more threat with these loans, they frequently require greater returns. This can mean rate of interest that are much greater than those of typical car loans (hard money lenders in atlanta georgia). An additional downside is the short find out Finance term. Tough money fundings are typically short-term fundings, generally around 12 months. This can tax the consumer to repay the Funding swiftly. These financings also have high charges and shutting prices. Consumers might need to pay numerous factors upfront, which can add substantially to the general expense of the Financing. These variables can make tough cash loans less appealing for some capitalists.

Real-Life Situations: When Hard Cash Financings Make Feeling

Where might hard cash financings be the ideal economic option? They typically make sense in situations where people or business need fast accessibility to capital. Real estate financiers looking to seize a time-sensitive possibility may not have the deluxe to wait for traditional financial institution fundings. Hard money lenders, with their faster approval and dispensation processes, can be the trick to safeguarding the home.

Here, the difficult money Funding can fund the improvement, boosting the building's worth. Hence, in real-life circumstances where rate and flexibility are important, hard cash financings can be the excellent service (hard money lenders in atlanta georgia).

Tips for Browsing Your First Hard Cash Finance

How does one efficiently navigate their first difficult cash Lending? Make certain the investment home has prospective profit enough to cover the Loan and create revenue. Hard money finances are short-term, usually 12 months.

Final thought

To conclude, hard money finances supply a fast, versatile funding choice genuine estate financiers wanting to take advantage of on time-sensitive chances. In spite of possible disadvantages like higher rates of interest, their simplicity of gain access to and emphasis on residential property worth over creditworthiness make them an attractive choice. With mindful factor to consider and audio financial investment approaches, tough money car loans can be a i thought about this powerful device for making best use of returns on temporary projects.

While conventional fundings might be acquainted to most, understanding the essentials of hard money car loans is crucial for possible financiers. Tough money lendings are a kind of temporary funding where the investor protects the Finance with actual estate home as collateral. Lenders are usually personal companies or individuals, making the Loan terms and rates even more versatile than click reference standard bank car loans. Unlike standard financial institution fundings, tough money lending institutions are primarily worried with the worth of the home and its prospective return on investment, making the authorization process less rigorous. Hard money financings are generally temporary loans, typically around 12 months.

Report this page